GST Calculator Australia Add & Subtract GST Money Matchmaker®

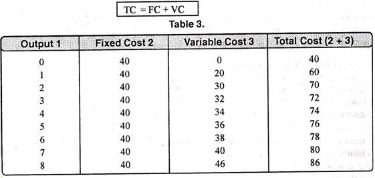

The GST slabs are currently set at 5%, 12%, 18% and 28% for most goods and services. QuickBooks Cash Flow enables you to forecast GST and other tax liabilities to make the BAS process more what is a natural business year straightforward. When you produce an invoice or expense, QuickBooks will automatically determine whether GST needs to be added. Use reports like “Transactions without GST” and “Transactions by tax code” to fully understand the calculations that make up your BAS. To determine how much GST was added, divide the GST-inclusive price by 11. If you want to see how much you’d save in GST by selling your business as a going concern, you can use our Australian Business GST Calculator.

Save with Wise on international money transfers.

For an intra-state transaction, you’ll need to calculate CGST & SGST/UTGST. In this case, the sum of CGST and SGST/UTGST is equal to the total GST amount. Intuit helps put more money in consumers’ and small businesses’ pockets, expense ratio calculator the real cost of fees saving them time by eliminating work, and ensuring they have confidence in every financial decision they make.

Therefore, if you own a business that sells products or services in Australia, you need to calculate how much GST to add to the base price of your offerings. You will only need to register for GST once, even if you operate more than one business, and can register online, over the phone, or through a registered agent when you first register your business. Since the introduction of GST, taxpayers can understand the taxes applied on goods and services at different stages of the production cycle.

Choosing an accountant

TaxAdda started in 2011 by Rohit Pithisaria and currently providing all types of services related to Income Tax, GST, Accounting to clients all over India.

When was GST introduced to Australia?

A GST calculator is a tool that helps in calculating the Goods and Services Tax (GST) for various products and services. The GST is a consumption tax levied on the value added to goods and services at each stage of production and distribution. This can help in ensuring compliance with GST regulations and accurate invoicing and billing. Some basic foods, education courses, and some medical, health and care products and services are GST-free, often referred to as exempt from GST. You don’t include GST in the price if your product or service is GST-free. You can still claim credits for the GST included in the price of purchases you use to make your GST-free sales.

You will also need to register your business for GST within 21 days of exceeding that turnover threshold. You can use our GST calculator to calculate the GST turnover of your business. Goods and Services Tax (GST) is a tax added on top of goods and services sold for domestic use. As a flat tax rate across most products and services, the idea of implementing it is to simplify the tax system and reduce tax avoidance.

You then multiply that figure by 10 to calculate the value of the product excluding GST. To quickly calculate the amount of GST payable on imported goods, you can use our free, online GST calculator. John is the owner of ‘John’s Hardware’ — a hardware and DIY store registered for GST.

- You can use our GST calculator to calculate the GST turnover of your business.

- Businesses — including non-profit organisations and self-employed individuals — will be required to register for GST if they meet certain conditions listed below.

- Includes a business canvas to streamline your planning and get you set up for success.

To calculate GST you’ll need to know which GST slab the product fits into. Terms and conditions, features, support, pricing, and service options subject to change without notice. The information on this website is intended to be general in nature and has been prepared without considering your objectives, financial situation or needs. You should read the relevant disclosure statements or other offer documents prior to making a decision about a credit product and seek independent financial advice. Most basic foods, some education courses and some medical, health and care products and services are exempt from GST — a full list of products and services are listed below.

If you’re a registered not-for-profit organization, you don’t have to pay GST as long as your turnover is less than $150,000. Includes a business canvas to streamline your planning and get you set up for success. You can quickly work out GST on a product or service by dividing the price of the product by 11. To calculate the GST on the product, we will first calculate the amount of GST included, then multiply that figure by 10% (The GST rate).

The calculator provided on money.com.au is intended for informational and illustrative purposes only. The results generated by this calculator are based on the inputs you provide and the assumptions set by us. These results should not be considered as financial advice or a recommendation to buy or sell any simplify fractions financial product.

Recent Comments